Irs 2019 Tax Computation Worksheet

Enter the result here and on the entry space on line 12a. Download Printable Irs Form 1040 In Pdf - The Latest Version Applicable For 2021.

See The Eic Earned Income Credit Table Income Tax Return Income Federal Income Tax

Heres the latest 1040 form information as of September 4 2020 from the Internal Revenue Service.

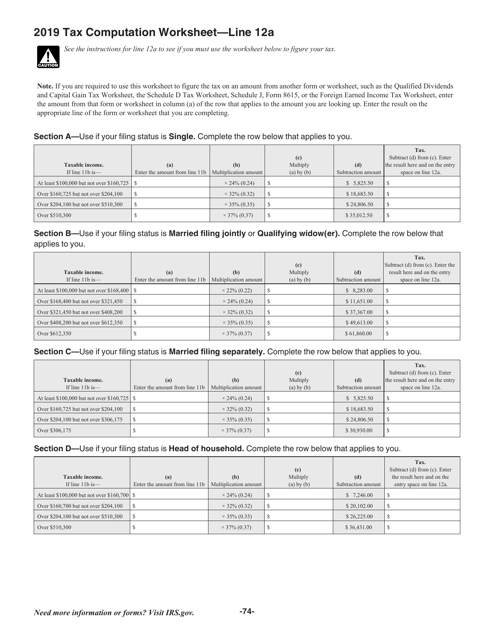

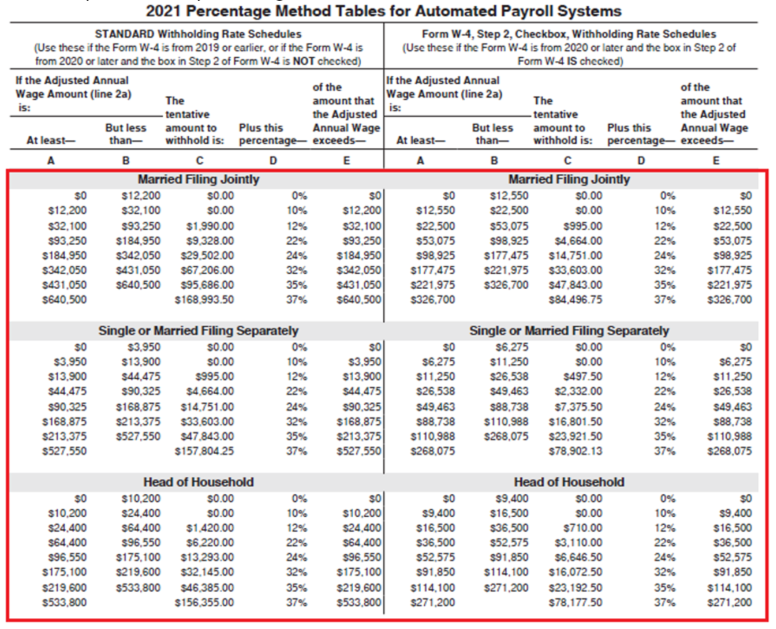

Irs 2019 tax computation worksheet. The 2019 Tax Computation WorksheetLine 12a form is 1 page long and contains. Fill Out The Line 12a Tax Computation Worksheet Online And Print It Out For Free. 237 2019 Tax Table.

A separate worksheet is used to calculate the tax instead of the tax tables for taxpayers with certain types of income such as capital gains qualifying dividends or foreign earned income for in-scope returns. Figure the tax on the amount on line 7. Per this IRM information is provided for Form 5403 using other schedules such as the tax computation Form 5384 and Form 5385 and the Form 5402 Appeals Transmittal and Case Memo.

The revised Form 1040 is out and it includes three new schedules as well as the current schedules like the Yearly Return and Routine C. IRS 2019 1040 Form Form 1040 Form is an IRS required tax form required from the US government for federal earnings taxes filed by citizens of United States. Use Worksheet 1-2 if you are a dependent for 2021 and for 2020 you had a refund of all federal income tax withheld because of no tax liability.

Select a category column heading in the drop down. 203 31 Credit for the Elderly or the Disabled. Section DTaxable incomeUse if your filing status is Head of household.

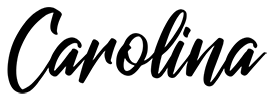

If we are not able to connect you to one of our tax professionals we will refund the. 210 32 Child Tax Credit and Credit for Other Dependents. Tax on taxable income is figured using the tax tables or the tax rate schedule for higher incomes.

You may be able to enter information on forms before saving or printing. Internal Revenue Service Foreign Earned Income Attach to Form 1040 or 1040-SR. If you received an audit letter based on your 2020 TurboTax return we will provide one-on-one support with a tax professional as requested through our Audit Support Center for returns filed with TurboTax for the current tax year 2020 and the past two tax years 2019 2018.

The brand new IRS 1040 form is out. Use Worksheet 1-1 if in 2020 you had a right to a refund of all federal income tax withheld because of no tax liability. If the amount on line 1 is less than 100000 use the Tax Table.

For information about any additional changes to the 2019 tax law or any other devel-1040 and 1040-SR. Does your 2019 return have a QDCGT Worksheet. 215 34 Earned Income Credit EIC.

Worksheet 1-3 Projected Tax for 2020. 200 30 Child and Dependent Care Credit. See IRSgov and IRSgovForms and for the latest information about developments related to Forms 1040 and 1040-SR and their instructions such as legislation enacted after they were published go to IRSgovForm1040.

Department Of The Treasury - Internal Revenue Service United States Federal Legal Forms And United States Legal Forms. On average this form takes 13 minutes to complete. Figure the tax on the amount on line 1.

213 33 Education Credits. 2019 and held until December 31 2019 a Unit holder would choose May from the left-hand side of the table and then choose the factor located under December from that row. 2019 Tax Computation WorksheetLine 12a.

Click on column heading to sort the list. Our job is to ensure that every taxpayer is treated fairly and that you know and. With those items the calculation is done on the Qualified Dividends and Capital Gains Tax Worksheet instead of solely the Tax Tables.

If the amount on line 7 is 100000 or more use the Tax Computation Worksheet. This is actually the largest class of forms in IRS. There are other computations as listed in the instructions to Form 1040 which are out of.

If the amount on line 7 is less than 100000 use the Tax Table to figure the tax. If line 11b is a Enter the amount from line 11b b Multiplication amount c Multiply a by b d Subtraction amount Tax. IRM 8710 Excise Tax Cases and IRA Adjustments does not require the preparation of the Form 5403 Worksheet for adjustments to excise tax returns.

Enter a term in the Find Box. Excise Tax Computations. 221 35 Premium Tax Credit PTC.

Add lines 20 23 and 24. Tax Computation Worksheet Homeschooldressage. Complete the Foreign Earned Income Tax Worksheet in the Instructions for Forms 1040 and 1040-SR if you enter an amount on line 45 or line 50.

Project the taxable income you will. SRT 2019 TAX 1. 28 How To Figure Your Tax.

Click on the product number in each row to viewdownload. Subtract d from c. Irs Form 1040 Is Often Used In Us.

Complete the row below that applies to you. Subtract d from c. The Taxpayer Advocate Service TAS is an independent organization within the Internal Revenue Service IRS that helps taxpayers and protects taxpayer rights.

Go to wwwirsgovForm2555 for instructions and the latest information. 235 36 Other Credits. 197 29 Tax on Unearned Income of Certain Children.

For a worksheet approach to computing a Unit holders income and expense amounts see the Tax Computation Worksheet on page 22. Its also one from the most often utilized as it contains lots of information that is vital when submitting federal income tax. If so those are taxed at a lower tax rate than ordinary income.

Also if you have a PDF of your 2019 return with all the worksheets look at the Form 1040 Worksheet. Audit Support Guarantee.

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Tax Forms

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Tax Tables Wild Country Fine Arts

Form 1040 Is One Of Three Irs Tax Forms Used For Personal Federal Income Tax Returns Filed With The Internal Revenue Irs Tax Forms Irs Taxes Federal Income Tax

See The Eic Earned Income Credit Table Income Tax Return Income Federal Income Tax

Irs Form 1040 Download Printable Pdf Or Fill Online Line 12a Tax Computation Worksheet 2019 Templateroller

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

W 4 Form 2020 What Is It And How To Fill Accountsconfidant Irs Forms Tax Consulting Tax Preparation

Self Employed Expense Worksheet Worksheets Are Definitely The Spine To Pupils Learni In 2021 Small Business Tax Deductions Small Business Tax Business Tax Deductions

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

50 Fake Irs Letter In Mail Fu1l In 2021 Lettering Worksheet Template Profit And Loss Statement

2021 Federal Tax Brackets What Is My Tax Bracket

1040 No Tax Or Tax Different Than Tax Table

2014 Federal Tax Tables Wild Country Fine Arts

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

0 comments